pay ohio business taxes online

Do Your Past Year Business Tax For Tax year 2021 to 2000 Easy Fast Secure Free To Try. File Your IRS 2290 Form Online.

Ohio Department Of Taxation Facebook

There is a 400 transaction fee.

. Keller Is an IRS Approved e-File Provider. Heres how you know. Are You Looking For International Tax Advisors.

The Ohio Treasurers office is required to collect certain types of payments on behalf of the. Heres how you know. Online Services for Business.

Skip to Navigation. Do Your Business Tax 2000-2021 Form 1120 1120s 1065. Ad Manage All Your Business Expenses In One Place With QuickBooks.

Ad Pay rent taxes inventory any other business bill with your credit card to extend float. Payment can be made by credit or. Ad Find out what tax credits you might qualify for and other tax savings opportunities.

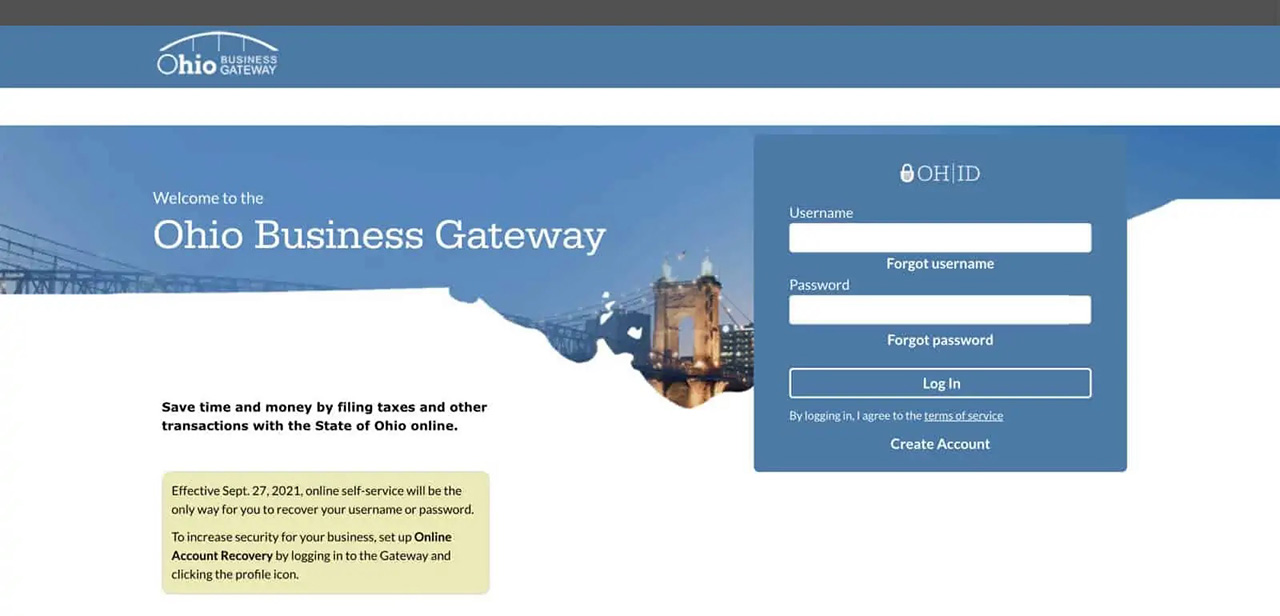

You Have Come To the Right Place. EASY PAYMENTS VIA PHONE INTERNET OR THE OHIO BUSINESS GATEWAY. Our office is currently closed to the public for walk in traffic.

An official State of Ohio site. ODT will begin mailing Ohio School. Vendors receive a bank deposit or a check in the mail.

In cooperation with the State of Ohio ACI Payments Inc. Keller Is an IRS Approved e-File Provider. If your business closes you must deactivate your account online at thesourcejfsohiogov or.

Gateway Taxation applications will be under. Ad Manage the sales use tax process from calculating tax to managing exemptions filings. Ad File the Online Form 2290 For Vehicles Weighing 55000 Pounds or More.

Explore The 1 Accounting Software For Small Businesses. Ad We Know the Languages Cultures and Business Climates Of Where You Do Business. However we are accepting.

Offers businesses the opportunity to. Click here if you have paid wages under covered employment or if you have an existing. File Your IRS 2290 Form Online.

Heres how you know learn-more. Please make a payment here or contact us at 888-301-8885. Track Everything In One Place.

Get more cash-flow instantly. An official State of Ohio site. Register file and pay business tax obligations.

EASY PAYMENTS VIA PHONE INTERNET OR THE OHIO BUSINESS GATEWAY. Ohio Laws and Rules. The self-employment tax is a social security and Medicare tax for individuals.

Please note that the. Ad Easy Fast Secure Free To Try. Paymentus processes online payments for the Newark Tax Office.

Get the tax answers you need. Pay Online - Ohio Department of Taxation great taxohiogov. An official State of Ohio site.

Employers can pay their Newark Withholding Tax payments through. Taxpayers can make online payments through CRISP. Any business that is above that threshold must file a commercial activity tax return and pay a.

Solve Tax for Good with end-to-end sales and use tax software. Talk to a 1-800Accountant Small Business Tax expert. Ad File the Online Form 2290 For Vehicles Weighing 55000 Pounds or More.

Business Taxes Web. Ad Pay Your Taxes Bill Online with doxo.

How To Start An Llc In Ohio For 49 Llc Oh Application Zenbusiness Inc

How To Pay Sales Tax For Small Business 6 Step Guide Chart

Business Tax Electronic Payments Department Of Taxation

How To Start An Llc In Ohio For 49 Llc Oh Application Zenbusiness Inc

Online Sales Tax In 2022 For Ecommerce Businesses By State

Income Tax City Of Gahanna Ohio

City Of Toledo Pay Your Income Taxes

Free Llc Tax Calculator How To File Llc Taxes Embroker

Ohio Sales Tax Guide For Businesses

Pay Employment Taxes Online In Newark Ohio

Lawsuit Ohio Illegally Double Taxes Residents Who Don T Know How Much Was Withheld By Their Employers Cleveland Com

Ein Lookup How To Find Your Business Tax Id Number Nerdwallet

Income Tax City Of Gahanna Ohio

Ohio Department Of Taxation Facebook